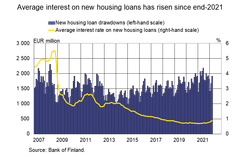

Interest rates on new housing loans rose in March 2022

The average interest rate on new housing loans stood at 0.87% in March 2022. The average interest rate has risen clearly (0.15 percentage points) during the last two months. The average interest has not been this high since November 2018. Interest rates on both owner-occupied housing loans and investment property loans have risen. The average interest rate on new owner-occupied housing loans stood at 0.85% in March 2022. At the same time, the interest rate on investment property loans was higher, at 1.05%.

The most common reference rate for housing loans, the 12-month Euribor, was still negative in March 2022, but it rose to positive levels in April 2021, for the first time in a long while. Recently, the average interest rate on new housing loans[1] is estimated to have been raised by the increasing popularity of interest rate hedges. Households can prepare for future changes in interest rates by interest rate hedging. Over the past year-half, interest rates on new housing loans have risen across almost all payback periods. As a rule, the interest rates on longer housing loans have risen somewhat more.

In March 2022, the volume of new housing loan drawdowns was EUR 1.9 billion, which is 8% less than a year earlier but 12% more than two years ago, at the onset of the pandemic. Investment property loans accounted for EUR 160 million of the new housing loans. At the end of March 2022, Finnish households had a total of EUR 107.3 billion of housing loans, including EUR 8.8 billion of investment property loans. The annual growth of the stock of investment properties (7.8%) was faster than that of the stock of owner-occupied housing loans (3.2%).

Loans

At the end of March 2022, Finnish households’ loan stock included EUR 16.7 billion of consumer credit and EUR 18.2 billion of other loans.

In March, Finnish households drew down new loans[2] worth EUR 3.0 billion, including EUR 530 million of housing corporations’ loans. The average interest rate on new corporate-loan drawdowns declined from February, to 1.4%. At the end of March, the stock of loans granted to Finnish non-financial corporations was EUR 100.0 billion, whereof loans to housing corporations accounted for EUR 40.2 billion.

Deposits

At the end of March 2022, the stock of Finnish households’ deposits totalled EUR 110.6 billion, and the average interest rate on these deposits was 0.03%. Overnight deposits accounted for EUR 101.7 billion and deposits with agreed maturity for EUR 2.1 billion of the total deposit stock. In March, Finnish households made new deposits agreements with an agreed maturity in the amount of EUR 63 million. The average interest rate on these new term deposits was 0.41%.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 31 May 2022.

Related statistical data and ‑graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] The average interest rate is affected by the cost of interest rate hedging. It is not possible to single out interest-rate hedged loans in the banking statistics.

[2] Excl. overdrafts and credit card credit.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Muistutuskutsu medialle: Eurooppa-päivän konferenssi 9.5.24.4.2025 13:53:27 EEST | Kutsu

Tervetuloa ajatushautomo Bruegelin ja Suomen Pankin yhteiseen Eurooppa-päivän konferenssiin 9. toukokuuta klo 8.30–11.50 Suomen Pankin auditoriossa (Rauhankatu 19, Helsinki).

Finlands Banks chefdirektör deltar i IMF:s vårmöte23.4.2025 12:00:00 EEST | Pressmeddelande

Finlands Banks chefdirektör Olli Rehn deltar i Internationella valutafondens (IMF) vårmöte som hålls i Washington D.C. 24–25 april 2025.

Suomen Pankin pääjohtaja IMF:n kevätkokoukseen23.4.2025 12:00:00 EEST | Tiedote

Suomen Pankin pääjohtaja Olli Rehn osallistuu Kansainvälisen valuuttarahaston (IMF) kevätkokoukseen Washington D.C:ssä 24.–25.4.2025.

Bank of Finland Governor to attend IMF Spring Meeting23.4.2025 12:00:00 EEST | Press release

The Governor of the Bank of Finland, Olli Rehn will participate in the International Monetary Fund’s Spring Meeting in Washington DC, on 24–25 April 2025.

Kutsu medialle: BOFIT julkaisee päivitetyn Kiinan talouden ennusteen maanantaina 28.4.202522.4.2025 09:32:41 EEST | Kutsu

Suomen Pankin nousevien talouksien tutkimuslaitos BOFIT julkaisee ennusteen Kiinan talouden kehityksestä maanantaina 28.4.2025 kello 16.00.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom