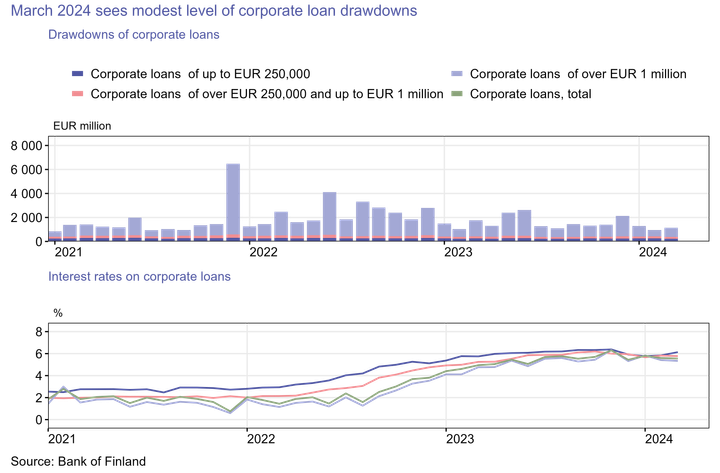

March 2024 sees modest level of corporate loan drawdowns

In March 2024, non-financial corporations (excl. housing corporations) drew down new loans1 from banks operating in Finland to a total of EUR 1.1 billion – the smallest amount in March since 2011. The average interest rate on new corporate loans fell slightly from February 20204, to 5.55% in March. Nearly half of the new corporate loans were taken out by companies in the sectors with the largest amounts of outstanding loans, namely real estate and manufacturing companies. Real estate companies took out 24% of the loans, at an average interest rate of 5.01%. Manufacturing companies took out 21%, at an average interest rate of 5.86%.

The average interest rates on new loans to non-financial corporations rose in March 2024 only in the category of small loans of up to EUR 250,000. In this loan category, the average interest rose by 0.29 percentage points from February, to 6.13%. The average interest on medium-sized loans (over EUR 250,000 and up to EUR 1 million) was 5.78%, remaining almost unchanged on February. The average interest on new large corporate loans of over EUR 1 million (5.34%) also fell slightly from February. The majority (67%) of the new corporate loans drawn down in March were loans of over EUR 1 million.

Of the new corporate loans taken out in March, 40% were with a maturity of over 5 years, and the average interest rate on these loans was 5.22%. A total of 35% were with a maturity of over 1 and up to 5 years, an the average interest in this category was 5.55%. The average interest on loans with a maturity of up to 1 year was 6.20%, and these loans accounted for 25% of the new corporate loan drawdowns.

Loans

Finnish households drew down new housing loans in March 2024 to a total of EUR 1.0 billion, a decline of EUR 220 million from March a year earlier. Of the newly drawn housing loans, buy-to-let mortgages accounted for EUR 100 million. The average interest rate on new housing loans rose from February, to 4.38%. At the end of March 2024, the stock of housing loans stood at EUR 106.2 billion, and the annual growth rate of the loan stock was -1.2%. Buy-to-let mortgages accounted for EUR 8.7 billion of the housing loan stock. Of the aggregate stock of Finnish households’ loans at the end of March, consumer credit amounted to EUR 17.8 billion and other loans, EUR 17.6 billion.

Drawdowns of new loans2 by Finnish non-financial corporations in March 2024 totalled EUR 1.6 billion, including EUR 410 million of loans to housing corporations. The average interest rate on new corporate loan drawdowns declined from February, to 5.35%. At the end of March, the stock of loans to Finnish non-financial corporations stood at EUR 107.6 billion, of which loans to housing corporations accounted for EUR 44.1 billion.

Deposits

At the end of March 2024, Finnish households’ aggregate deposit stock totalled 109.0 billion, and the average interest rate on the deposits was 1.31%. Overnight deposits accounted for EUR 68.0 billion and deposits with agreed maturity for EUR 12.7 billion of the deposit stock. In March, Finnish households made new agreements on deposits with agreed maturity in the amount of EUR 1,170 million, at an average interest rate of 3.54%.

For further information, please contact:

- Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi

- Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 30 May 2024.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics2/.

1 Excl. overdrafts and credit card credit.

2 Excl. overdrafts and credit card credit.

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Det är inte läge att skjuta upp lösningarna för Finlands offentliga finanser19.12.2025 11:00:00 EET | Pressmeddelande

Finlands offentliga finanser befinner sig alltjämt långt från balans. För att vända skuldsättningsutvecklingen krävs en betydande konsolidering av de offentliga finanserna och investeringar i tillväxt. Höjningen av de nödvändiga försvarsutgifterna försvårar den offentligfinansiella konsolideringen. Inflationen i euroområdet ligger på målet och ekonomin har vuxit något snabbare än förutsett.

Suomen julkisen talouden ratkaisuja ei kannata lykätä19.12.2025 11:00:00 EET | Tiedote

Suomen julkinen talous on edelleen kaukana tasapainosta. Velkaantumiskehityksen kääntäminen vaatii merkittävää julkisen talouden sopeuttamista ja investointeja kasvuun. Välttämättömien puolustusmenojen kasvattaminen vaikeuttaa tasapainottamista. Euroalueella inflaatio on tavoitteessa ja talous on kasvanut hieman ennustettua paremmin.

Finland’s decisions on public finances should not be postponed19.12.2025 11:00:00 EET | Press release

Finland’s public finances are still far from being in balance. Reversing the rise in public debt will require considerable fiscal consolidation and investments in growth. An expansion of essential defence spending will hamper the fiscal adjustment process. Inflation in the euro area is at target, and growth in the euro area economy has been slightly higher than forecast.

Återhämtningen i Finlands ekonomi går sakta framåt19.12.2025 11:00:00 EET | Pressmeddelande

Finlands ekonomi lämnar snart perioden med svag tillväxt bakom sig, men ingen kraftig tillväxt väntas under åren framöver. Inflationen är fortsatt måttfull och sysselsättningen stiger gradvis. Den stramare handelspolitiken och globala politiska osäkerheter samt eventuella åtgärder för konsolidering av de offentliga finanserna kastar en skugga över tillväxtutsikterna för ekonomin i Finland. De offentliga finanserna uppvisar alltjämt ett djupt underskott.

Suomen talouden elpyminen etenee maltillisesti19.12.2025 11:00:00 EET | Tiedote

Suomen talouden hitaan kasvun jakso on jäämässä taakse, mutta voimakasta kasvua ei lähivuosina ole odotettavissa. Inflaatio pysyy maltillisena ja työllisyys kohenee vähitellen. Talouden kasvunäkymiä varjostavat kauppapolitiikan kiristyminen ja kansainvälisen politiikan epävarmuudet sekä mahdolliset julkisen talouden sopeutustoimet. Julkinen talous säilyy syvästi alijäämäisenä.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom