Housing loan drawdowns down from a year earlier in May

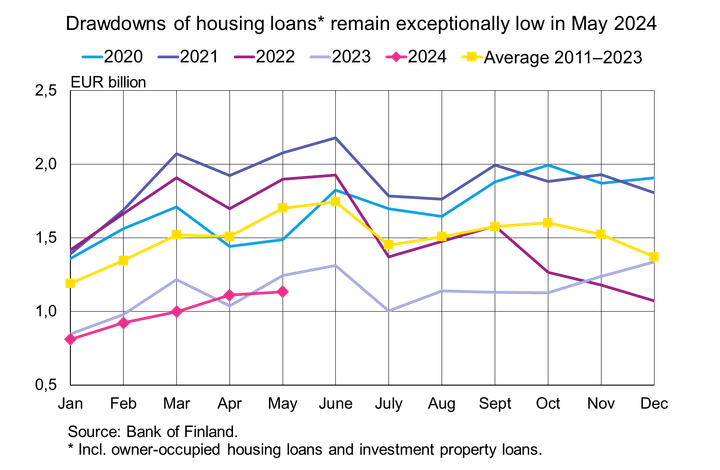

Finnish households drew down exceptionally few housing loans in May 2024. New drawdowns amounted to EUR 1.1 billion, which is 8.8% below the total for May 2023 and 33% below the May average in 2011–2023. The last time the level of housing loan drawdowns was lower in May was in 2002.

Investment property loans accounted for EUR 100 million, or 9%, of the housing loans taken out in May 2024. Year on year, these drawdowns increased by 12.2%. Drawdowns of owner-occupied housing loans, in turn, were 10.4% down year on year. In May 2024, the average interest rate on drawdowns of owner-occupied housing loans was 4.33% and on investment property loans 4.52%.

Due to the exceptionally low amount of housing loan drawdowns, the aggregate stock of housing loans contracted in May by 1.0% from a year earlier. The stock of owner-occupied housing loans contracted in May by 1.2%. The stock of investment property loans, in turn, grew by 0.4%, while in May 2023 it had contracted by 1.6%. In month on month terms, the stock of investment property loans has now grown for five months in a row.

At the end of May 2024, the stock of owner-occupied housing loans and of investment property loans stood at EUR 97.3 billion and EUR 8.7 billion, respectively. The average interest rate on the housing loan stock (EUR 106.0 billion) was slightly down from April, at 4,07%. At the end of May, the average interest rate on the stock of owner-occupied housing loans was was 4.05% and on the stock of investment property loans 4.27%.

Despite the increase in households’ interest payments, the amount of non-performing1 housing loans has remained low, although their share of the loan stock has grown slightly from the end of 20222. At the end of May 2024, 1.7% of the stock of owner-occupied housing loans were non-performing loans. The corresponding figure for the stock of investment property loans was 1.2%.

Loans

At the end of May 2024, Finnish households’ loan stock comprised EUR 17.9 billion in consumer credit and EUR 17.4 billion in other loans. Drawdowns of new loans by Finnish non-financial corporations in May totalled EUR 2.1 billion, including EUR 450 million of loans to housing corporations. The average interest rate on new corporate loan drawdowns fell from April, to 5.40%. At the end of May, the stock of loans to Finnish non-financial corporations stood at EUR 108.1 billion. Of this, EUR 44.4 billion was to housing corporations.

Deposits

At the end of May 2024, the aggregate stock of Finnish households’ deposits totalled EUR 109.1 billion, and the average interest rate on the deposits was 1.35%. Overnight deposits accounted for EUR 67.0 billion and deposits with agreed maturity for EUR 13.5 billion of the deposit stock. In May, Finnish households made EUR 1.1 billion of new agreements on deposits with an agreed maturity, at an average interest rate of 3.56%.

For further information, please contact:

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi

Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 29 July 2024.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics2/.

[1] A loan is non-performing when the exposure is more than 90 days past-due or the borrower is unlikely to pay.

[2] At the end of December 2022, non-performing loans accounted for 1.4% of the stock of owner-occupied housing loans and for 0.9% of the stock of investment property loans.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.1–30.6.202622.12.2025 13:30:00 EET | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.1–30.6.2026. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.1.–30.6.202622.12.2025 13:30:00 EET | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.1.–30.6.2026 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

Reference rate and penalty interest rates for 1 January – 30 June 202622.12.2025 13:30:00 EET | Press release

The reference rate under section 12 of the Interest Act (633/1982) for the period 1 January – 30 June 2026 is 2.5 %. The penalty interest rate for the same period is 9.5 % pa (under section 4 of the Act, the reference rate plus seven percentage points). The penalty interest rate applicable to commercial contracts is 10.5 % pa (under section 4 a of the Act, the reference rate plus eight percentage points).

Det är inte läge att skjuta upp lösningarna för Finlands offentliga finanser19.12.2025 11:00:00 EET | Pressmeddelande

Finlands offentliga finanser befinner sig alltjämt långt från balans. För att vända skuldsättningsutvecklingen krävs en betydande konsolidering av de offentliga finanserna och investeringar i tillväxt. Höjningen av de nödvändiga försvarsutgifterna försvårar den offentligfinansiella konsolideringen. Inflationen i euroområdet ligger på målet och ekonomin har vuxit något snabbare än förutsett.

Suomen julkisen talouden ratkaisuja ei kannata lykätä19.12.2025 11:00:00 EET | Tiedote

Suomen julkinen talous on edelleen kaukana tasapainosta. Velkaantumiskehityksen kääntäminen vaatii merkittävää julkisen talouden sopeuttamista ja investointeja kasvuun. Välttämättömien puolustusmenojen kasvattaminen vaikeuttaa tasapainottamista. Euroalueella inflaatio on tavoitteessa ja talous on kasvanut hieman ennustettua paremmin.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom