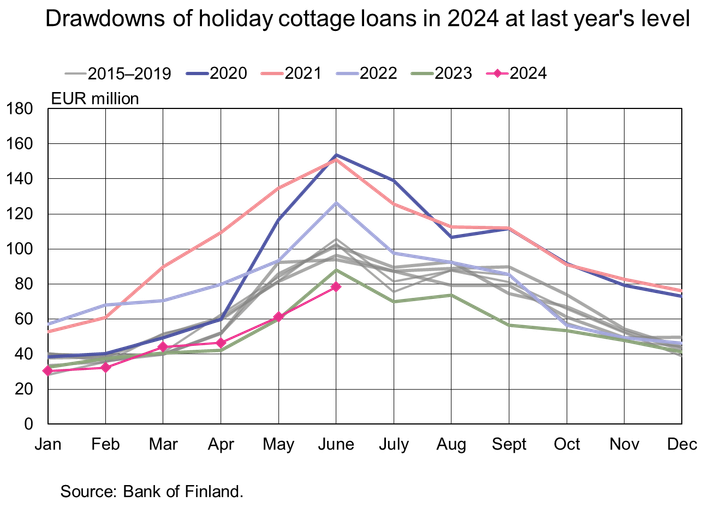

Drawdowns of holiday cottage loans continued in the first half of 2024 at last year’s pace

In June 2024, Finnish households drew down new housing loans for the purchase of holiday homes (holiday cottage loans) in the value of EUR 78 million, which is 11% less than a year earlier in June. However, the amount drawn down in January–June 2024 was almost the same as in the comparable period in 2023. The demand for holiday cottage loans usually peaks in May–September, and June is typically the month with the largest drawdowns. During the pandemic in 2020 and 2021, an unusually high volume of holiday cottage loans was drawn down.

The average interest rate on new drawdowns of holiday cottage loans declined slightly from May, to stand at 4.49% in June. Similarly to housing loans, the majority of holiday cottage loans is linked to Euribor rates. In June 2024, 95% of new drawdowns of holiday cottage loans were linked to Euribor rates.

The most common reference rate, also for holiday cottage loans, is the 12-month Euribor. However, following the rise in interest rates, shorter Euribor rates are now being used increasingly as a reference rate for holiday cottage loans, similarly to housing loans. In June 2024, 62% of new Euribor-linked holiday cottage loans were linked to the 1-year Euribor, 8% to the 6-month Euribor and 29% to the 3-month Euribor. During the times of the lowest interest rates in recent years, the 1-year Euribor has typically accounted for 80–90% of the reference rates of holiday cottage loans.

Due to the reduced drawdown volumes, the year-on-year contraction of the stock of holiday cottage loans has continued already for over a year. In June 2024, the stock of households’ holiday cottage loans contracted by 2.5% in year-on-year terms, as opposed to 1.4% last year’s June. At the end of June 2024, the stock of holiday cottage loans stood at EUR 4.4 billion. The average interest on the stock of holiday cottage loans decreased slightly from May to stand at 4.34% in June. 95% of the stock of holiday cottage loans was linked to Euribor rates.

Loans

In June 2024, Finnish households drew down EUR 1.1 billion of new housing loans, which is EUR 220 million less than in the same period a year earlier. Buy-to-let mortgages accounted for EUR 100 million of the new housing loan drawdowns. The average interest rate on new housing loans decreased from May to stand at 4.31% in June. At the end of June 2024, the housing loan stock totalled EUR 106.0 billion, and its year-on-year growth rate was −0.9%. Buy-to-let mortgages accounted for EUR 8.7 billion of the housing loan stock. At the end of June, the household loan stock included EUR 17.9 billion of consumer credit and EUR 17.5 billion of other loans.

Drawdowns of new loans[1] by Finnish non-financial corporations in June totalled EUR 3.2 billion, including EUR 780 million of loans to housing corporations. The average interest rate on new corporate-loan drawdowns declined from May to 5.24%. At the end of June, the stock of loans granted to Finnish non-financial corporations was EUR 108.1 billion, whereof loans to housing corporations accounted for EUR 44.6 billion.

Deposits

At the end of June 2024, Finnish households’ aggregate deposit stock totalled EUR 110.8 billion, with an average interest rate of 1.34%. Overnight deposits accounted for EUR 68.1 billion and deposits with agreed maturity for EUR 14.0 billion of the total deposit stock. In June, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.2 billion, at an average interest rate of 3.56%.

For further information, please contact:

Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 29 August 2024.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics2/.

[1] Excl. overdrafts and credit card credit.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Inlåningen från hushållen var den största genom tiderna i november 20257.1.2026 10:00:00 EET | Pressmeddelande

Inlåningen från hushållen har ökat 2025 samtidigt som inlåningsräntorna har sjunkit. Inlåningen har ökat i alla inlåningsformer. Dessutom ingick finländska företag i november rikligt med nya avtal om tidsbunden inlåning.

Kotitalouksien talletuskanta oli kaikkien aikojen suurin marraskuussa 20257.1.2026 10:00:00 EET | Tiedote

Kotitaloudet ovat kasvattaneet talletuksiaan vuonna 2025 samaan aikaan kun talletusten korot ovat laskeneet. Talletukset ovat kasvaneet kaikissa talletusmuodoissa. Lisäksi suomalaiset yritykset solmivat marraskuussa runsaasti uusia määräaikaistalletussopimuksia.

Households' deposit stock at all-time high in November 20257.1.2026 10:00:00 EET | Press release

Households have increased their deposits in 2025 while interest rates on deposits have declined. Deposits have grown in all deposit categories. In addition, Finnish corporations concluded a high volume of new agreements on deposits with agreed maturity in November.

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.1–30.6.202622.12.2025 13:30:00 EET | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.1–30.6.2026. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.1.–30.6.202622.12.2025 13:30:00 EET | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.1.–30.6.2026 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom