Value and number of contactless payments grew in the second quarter of 2024

4.9.2024 10:00:00 EEST | Suomen Pankki | Press release

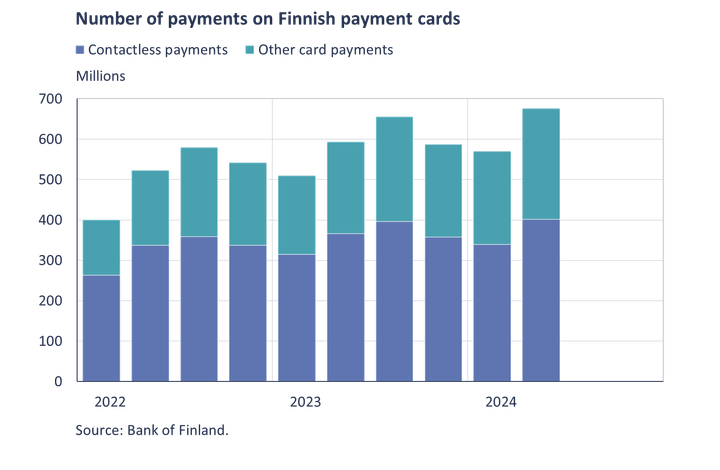

The second quarter of 2024 saw the highest quarterly value of card payments on record since 2022 at EUR 19.0 billion, i.e. EUR 0.5 billion above the previous peak. This represents continuation of a long-term upward trend. In the second quarter of 2024, Finnish payment cards were used to make a total of 635 million card payments, i.e. 7% more than in the corresponding period a year earlier.

The aggregate value of contactless payments made in the second quarter of 2024 was EUR 6.8 billion, 18% more than in the corresponding period a year earlier. In the second quarter, a total of 402 million card payments were made using the contactless feature, 10% more than in the second quarter of 2023. In comparison with the first quarter, the number of contactless payments also increased by 62 million (18%), and the aggregate value grew by EUR 1.2 billion (22%) in the second quarter of 2024.

A total of 106 million remote card payments were initiated on a computer or mobile device in the second quarter of 2024, i.e. 20% more than in the same period last year. The aggregate value of remote card payments (EUR 4.1 billion) grew 19% year-on-year.

The number of card payments made using a microchip or magnetic strip decreased by 16% year-on-year to 127 million transactions in the second quarter of 2024. Their aggregate value also decreased by EUR 0.5 billion (6%) year-on-year to EUR 8.0 billion in the second quarter of 2024.

Cards issued in other euro area countries than Finland were used to make card payments totalling EUR 158 million in Finland at domestic[1] payment terminals in the second quarter of 2024, i.e. 15% less than in the corresponding period last year.

The figures discussed in this news release have been published in the new payment statistics dashboard. The contents of the dashboard will be extended later.

For further information, please contact:

Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi,

Tia Kurtti, tel. +358 9 183 2043, email: tia.kurtti(at)bof.fi

The next quarterly payment statistics release will be published in December 2024.

1 In Finland, there are also payment terminals of foreign cross-border providers, and payments at these terminals are not included in the Bank of Finland’s statistics on received card payments.

Keywords

Images

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kontaktlös betalning blev vanligare i oktober–december 2025 jämfört med motsvarande tidpunkt året innan5.3.2026 10:00:00 EET | Pressmeddelande

Med kort betalades i oktober–december mer än under motsvarande period året innan. Framför allt gjordes under det sista kvartalet fler kontaktlösa betalningar än under motsvarande period 2024.

Lähimaksaminen oli yleisempää loka-joulukuussa 2025 kuin vastaavana ajankohtana edellisvuonna5.3.2026 10:00:00 EET | Tiedote

Korteilla maksettiin loka-joulukuussa enemmän kuin viime vuonna vastaavana ajanjaksona. Erityisesti lähimaksuja tehtiin vuoden viimeisellä neljänneksellä enemmän kuin vuonna 2024 samalla ajanjaksolla.

Contactless payments increased in October–December 2025 from a year earlier5.3.2026 10:00:00 EET | Press release

Cards payments in October–December grew year-on-year. In particular, more contactless payments were made in the fourth quarter than in same period in 2024.

Hushållens utestående konsumtionskrediter över 28 miljarder euro4.3.2026 10:00:00 EET | Pressmeddelande

Hushållens totala utestående konsumtionskrediter uppgick vid utgången av 2025 till 28,2 miljarder euro och årsökningen har mattats av till 0,1 %. Av hushållens totala utestående konsumtionskrediter bestod ungefär hälften av konsumtionskrediter utan säkerhet (exkl. fordonslån) och deras årsökning var 1,5 %.

Kotitalouksien kulutusluottokanta yli 28 mrd. euroa4.3.2026 10:00:00 EET | Tiedote

Kotitalouksien kokonaiskulutusluottokanta oli vuoden 2025 lopussa 28,2 mrd. euroa ja sen vuosikasvuvauhti oli hidastunut 0,1 prosenttiin. Kotitalouksien kokonaiskulutusluottokannasta noin puolet oli vakuudettomia kulutusluottoja (pl. ajoneuvolainat), ja niiden vuosikasvuvauhti oli 1,5 %.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom