E-commerce grew in the first half of 2024

In the first half of 2024, Finnish payment service providers’ customers made more e-commerce payments with cards and credit transfers than in the same period last year. The payments amounted to 234 million transactions, with an aggregate value of EUR 11.8 billion. Year on year, the number of e-commerce payments increased by 14% (29 million payments) and their value in euro terms increased by 12% (EUR 1.3 billion).

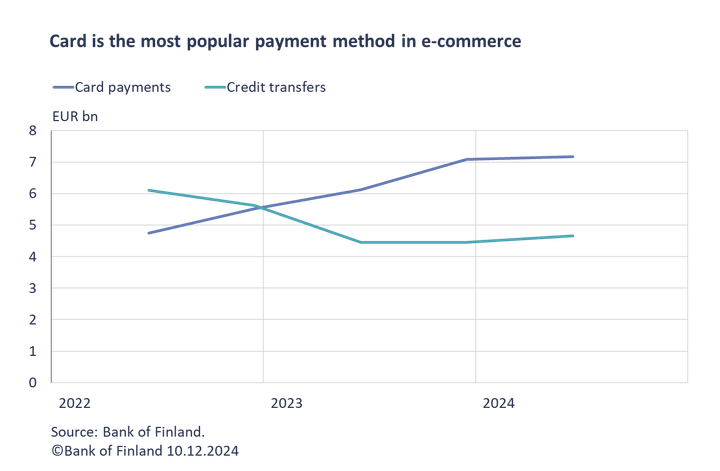

In terms of the number of e-commerce transactions, 78% of the payments were made using cards and 22% using credit transfer in the first half of 2024. However, credit transfers on average were larger than card payments, and they amounted to 40% of the total euro amount of payments. The average value of a credit transfer in e-commerce was EUR 91, in contrast with the average value of EUR 39 for card payments in the first half of 2024.

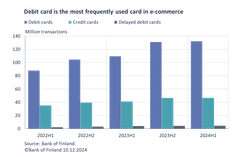

October 2023 saw the entry into force of amendments of the Consumer Protection Act requiring e-merchants to rearrange payment methods so that those allowing the use of a credit card or the application for new credit to complete the payment are presented lower. In the first half of 2024, credit cards were used approximately 47 million times to pay e-commerce purchases, which was about the same as in the previous year-half. However, in contrast with the first half of 2023, the number of credit card payments grew by 13%. The number of online payments with other types of cards has grown continuously throughout the period covered by the semi-annual statistics, starting from 2022. Debit cards are the most popular cards in e-commerce: they were used in 132 million transactions amounting to EUR 4.1 billion in the first half of 2024.

The majority of credit transfers in e-commerce are initiated with an e-payment button. In the first half of 2024, 39 million payments were made with an e-payment button, amounting to a total of EUR 3.0 billion. The number of payments initiated with an e-payment button has decreased slightly from the corresponding period of 2022 and 2023, when the number of such payments amounted to almost 40 million. However, a greater drop took place in the value of these payments, since the value of payments initiated with an e-payment button was still EUR 4.8 billion in the first half of 2022. The most common method of online payment is to enter the details of the payment card directly at the e-merchant’s store checkout. A total of 152 million payments related to e-commerce were initiated using a card in the first half of 2024.

The online purchases of Finnish PSPs’ customers were focused on Finland and the euro area. A total of 162 million payments amounting to EUR 9.0 billion were made to Finland and 50 million payments worth EUR 2.0 billion to the rest of the euro area. Purchases from non-euro area EU countries amounted to EUR 0.4 billion and purchases from outside the EU to 0.5 billion in the first half of 2024. In the first half of 2024, euro area e-commerce saw the fastest growth: 26% in terms of the number of transactions year on year. In the same period, payments to non-EU e-merchants grew almost similarly in terms of the number of transactions (22%), but only 4% in terms of value.

The figures discussed in this news release have been published in the payment statistics dashboard.

For further information, please contact:

Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi,

Tia Kurtti, tel. +358 9 183 2043, email: tia.kurtti(at)bof.fi

The next semi-annual news release on payment statistics will be published at 10 a.m. on 6 June 2025.

Images

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.1–30.6.202622.12.2025 13:30:00 EET | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.1–30.6.2026. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.1.–30.6.202622.12.2025 13:30:00 EET | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.1.–30.6.2026 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

Reference rate and penalty interest rates for 1 January – 30 June 202622.12.2025 13:30:00 EET | Press release

The reference rate under section 12 of the Interest Act (633/1982) for the period 1 January – 30 June 2026 is 2.5 %. The penalty interest rate for the same period is 9.5 % pa (under section 4 of the Act, the reference rate plus seven percentage points). The penalty interest rate applicable to commercial contracts is 10.5 % pa (under section 4 a of the Act, the reference rate plus eight percentage points).

Det är inte läge att skjuta upp lösningarna för Finlands offentliga finanser19.12.2025 11:00:00 EET | Pressmeddelande

Finlands offentliga finanser befinner sig alltjämt långt från balans. För att vända skuldsättningsutvecklingen krävs en betydande konsolidering av de offentliga finanserna och investeringar i tillväxt. Höjningen av de nödvändiga försvarsutgifterna försvårar den offentligfinansiella konsolideringen. Inflationen i euroområdet ligger på målet och ekonomin har vuxit något snabbare än förutsett.

Suomen julkisen talouden ratkaisuja ei kannata lykätä19.12.2025 11:00:00 EET | Tiedote

Suomen julkinen talous on edelleen kaukana tasapainosta. Velkaantumiskehityksen kääntäminen vaatii merkittävää julkisen talouden sopeuttamista ja investointeja kasvuun. Välttämättömien puolustusmenojen kasvattaminen vaikeuttaa tasapainottamista. Euroalueella inflaatio on tavoitteessa ja talous on kasvanut hieman ennustettua paremmin.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom