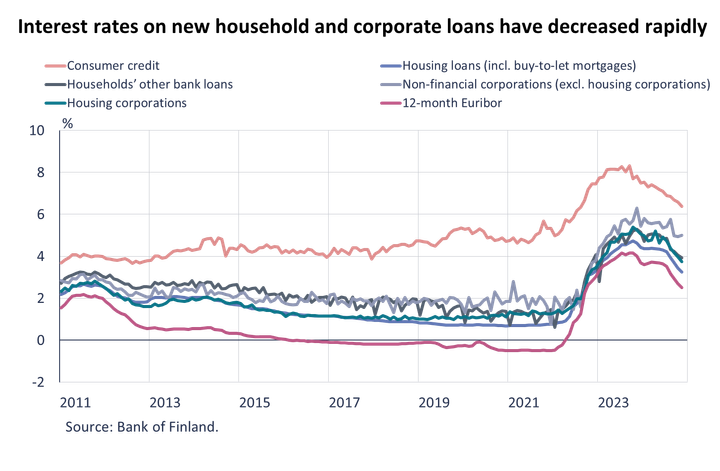

Interest rates on new household and corporate loans have decreased rapidly

The average interest rate on new household and corporate loans has decreased rapidly, and the average interest rates on the loan stocks have begun to recede. The one-year Euribor has declined from its autumn-2023 peak of 4.2% to below 2.5%. In November 2024, 86% of the stock of bank loans1 to Finnish households and non-financial corporations2 (EUR 249.1 bn) and 85% of new drawdowns3 was linked to Euribor rates.

In November, the average interest rate on new household loans declined below 4% for the first time in over two years. Just a year ago in November, the average interest rate stood at 5.42%. Out of all bank loans drawn down by households in November 2024, 69% was housing loans, 21% was consumer credit and 10% was other loans. The average interest rate on the stock of household loans (EUR 141.2 bn) continued to decline in November, to reaching 4.24% for the month. In addition to the decline in the interest rates on new loans, the drop in the average interest rate on the loan stock reflects a decrease in the interest rates on old variable-rate loans due to scheduled interest rate resets.

In November 2024, the average interest rate on new loans to non-financial corporations (excl. housing corporations) was slightly below 5%, as opposed to an average of 6.29% a year earlier. The average interest rate on the corporate loan stock (EUR 62.5 bn) has decreased to 4.39% starting from the beginning of 2024.

The average interest rate on loans to housing corporations has also declined rapidly. In November 2024, the average interest rate on new loans stood at 3.74%, as opposed to 5.24% just in November last year. At the end of November 2024, the average interest rate on the stock of loans to housing corporations was an even 4%. It has declined by 0.5 percentage points during 2024. A little over half of the stock of housing corporations’ loans was housing company loans payable by households4.

Loans

New drawdowns of housing loans by Finnish households amounted to EUR 1.3 billion in November 2024, which is 6% more than in the same period a year earlier. Buy-to-let housing loans accounted for EUR 124 million of the new housing loan drawdowns. The average interest rate on new housing loans decreased from October, to stand at 3.26% in November. At the end of November 2024, the housing loan stock totalled EUR 106.0 billion, and its year-on-year change amounted to 0.4%. Buy-to-let housing loans accounted for EUR 8.8 billion of the housing loan stock. At the end of November, Finnish households held EUR 17.8 billion of consumer credit and EUR 17.4 billion of other loans.

In November, Finnish households drew down new loans worth EUR 2.1 billion, including EUR 659 million of housing corporations’ loans. The average interest rate on new corporate-loan drawdowns declined from October to 4.60%. At the end of November, the stock of loans granted to Finnish non-financial corporations stood at EUR 107.9 billion, including EUR 45.4 billion of loans to housing corporations.

Deposits

At the end of November 2024, Finnish households’ aggregate deposit stock totalled EUR 111.0 billion, and the average interest rate on these deposits was 1.29%. Overnight deposits accounted for EUR 67.7 billion and deposits with an agreed maturity for EUR 15.1 billion of the total deposit stock. In November, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.2 billion. In November, the average interest rate on new deposits with an agreed maturity was 2.98%.

For further information, please contact:

- Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

- Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 30 January 2025.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

1 Loans granted by credit institutions operating in Finland.

2 Including housing corporations.

3 Excluding overdrafts and credit card credit.

4 According to an estimate by Statistics Finland, the total amount of housing company loans payable by households was EUR 23.0 billion at the end of September 2024 (link).

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Finlands Banks chefdirektör deltar i IMF:s årsmöten15.10.2025 11:00:00 EEST | Pressmeddelande

Finlands Banks chefdirektör Olli Rehn deltar i Internationella valutafondens (IMF) och Världsbankens gemensamma årsmöte i Washington DC den 17 oktober 2025. Chefdirektör Rehn företräder Finland i valutafondens styrelse.

Suomen Pankin pääjohtaja IMF:n vuosikokouksiin15.10.2025 11:00:00 EEST | Tiedote

Suomen Pankin pääjohtaja Olli Rehn osallistuu Kansainvälisen valuuttarahaston (IMF) ja Maailmanpankin yhteiseen vuosikokoukseen Washington DC:ssä 17.10.2025. Pääjohtaja Rehn edustaa Suomea valuuttarahaston hallintoneuvostossa.

Governor of the Bank of Finland to attend IMF Annual Meetings15.10.2025 11:00:00 EEST | Press release

Governor of the Bank of Finland Olli Rehn will attend the Joint Annual Meeting of the International Monetary Fund (IMF) and World Bank Group (WBG) in Washington DC on 17 October 2025. Governor Rehn represents Finland on the IMF Board of Governors.

Kutsu medialle: BOFIT-webinaari: Venäjän talouden ennuste vuosille 2025–202710.10.2025 09:11:05 EEST | Kutsu

Suomen Pankin nousevien talouksien tutkimuslaitos BOFIT julkaisee päivitetyn ennusteen Venäjän talouskehityksestä vuosille 2025–2027. Ennusteesta järjestetään webinaari maanantaina 20.10.2025 klo 16.00.

I augusti 2025 utbetalades mindre studielån än ett år tidigare26.9.2025 10:00:00 EEST | Pressmeddelande

Finländarna lyfte i augusti 2025 studielån till ett värde av 143 miljoner euro, vilket är 13 % mindre än vid motsvarande tid året innan. Från början av augusti kunde högskolestuderande lyfta låneandelen för hela höstterminen och studerande på andra stadiet den första låneandelen för höstterminen. Utbetalningarna var i genomsnitt något över 3 000 euro i augusti 2025. Uppskattningsvis över hälften av utbetalningarna gjordes till fullt belopp.[1] Maximibeloppen och utbetalningsdagarna för det statsgaranterade studielånet är för det nya läsåret motsvarande som tidigare[2].

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom