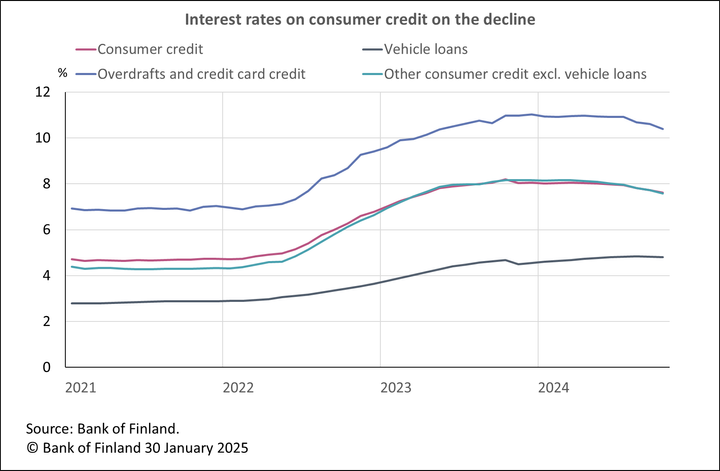

Interest rates on new consumer credit lower

In December 2024, the average interest rate on new consumer credit[1] taken out by Finnish households was 6.04%, down 1.46 percentage points from December 2023. The average interest rate on new consumer credit (excl. vehicle loans) peaked at over 10% in July 2023. By the end of December 2024, the average interest had fallen to 7.44%. The lower interest rates on consumer credit were partly explained by declining Euribor rates in 2024. A total of 57% of all consumer credit is linked to Euribor rates.

Finnish households drew down of new consumer credit[2] in December 2024 to a total of EUR 369 million, an increase of 2.5% on December a year earlier. Drawdowns of vehicle loans and other consumer credit amounted to EUR 165 million and EUR 204 million, respectively. The increase in drawdowns was due to vehicle loans, which were up by approximately EUR 15 million on December 2023. Drawdowns of other consumer credit, in turn, were down 2.7% on December 2023.

At the end of December 2024, the average interest rate on the stock of consumer credit granted by credit institutions stood at 7.61%. There are large differences in the interest rates on consumer credit by credit type. The average interest rate on the stock of vehicle loans was 4.81% in December. The other consumer credit types are, on average, considerably more expensive for households: the average interest rate on overdrafts and credit card credit was 10.40%, and the average interest on other consumer credit was 7.57%. Secured consumer credit is, on average, significantly cheaper for households: in December, the average interest rate on the stock of unsecured overdrafts and credit card credit was 10.86%, whereas that on the secured stock was 6.19%. Similarly, in the category of other consumer credit (excl. vehicle loans), unsecured credit was 4.23 percentage points more expensive on average than secured credit.

The total stock of consumer credit stood at EUR 17.8 billion. Vehicle loans accounted for 26% of the credit stock.[3] Consumer credit granted by credit institutions (banks) operating in Finland accounts for 67% of all consumer credits of Finnish households.[4] Of the vehicle loans, 57% were granted by credit institutions and the remaining 43% by other financial institutions.

Loans

Finnish households drew down new housing loans in December 2024 to a total of EUR 1.1 billion, a decrease of EUR 200 million on the same month a year earlier. Of the newly drawn housing loans, buy-to-let mortgages accounted for EUR 120 million. The average interest rate on new housing loans fell from November, to 3.17% in December. At the end of December 2024, the stock of housing loans stood at EUR 105.8 billion, with an annual growth rate of -0.8%. Buy-to-let mortgages accounted for EUR 8.8 billion of the housing loan stock. Of the total stock of loans to Finnish households, other loans accounted for EUR 17.4 billion.

Drawdowns of new loans[5] by Finnish non-financial corporations in December 2024 totalled EUR 3.6 billion, of which EUR 620 million was loans to housing corporations. The average interest rate on newly drawn corporate loans was down on November, at 4.20%. At the end of December 2024, the stock of loans to Finnish non-financial corporations stood at EUR 106.4 billion, of which loans to housing corporations accounted for EUR 45.1 billion.

Deposits

The stock of deposits held by Finnish households at the end of December 2024 totalled EUR 110.2 billion, and the average interest rate on the deposits was 1.23%. Overnight deposits accounted for EUR 67.2 billion and deposits with agreed maturity for EUR 15.0 billion of the deposit stock. In December, Finnish households made EUR 1,080 million of new agreements on deposits with agreed maturity, at an average interest rate of 2.79%.

For further information, please contact:

- Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi

- Olli Tuomikoski, tel. +358 9 183 2925, emai: olli.tuomikoski(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 28 February 2025.

Related statistical data and graphs are also available on the Bank of Finland website.

[1] Excl. overdrafts and credit card credit.

[2] Excl. overdrafts and credit card credit.

[3] In the Bank of Finland’s financial statistics, a vehicle loan is unsecured if the vehicle is used as collateral for the loan.

[4] At the end of the third quarter of 2024, the total stock of consumer credit to Finnish households stood at EUR 26.6 billion.

[5] Excl. overdrafts and credit card credit.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Eurosystemets penningpolitiska beslut17.4.2025 15:18:52 EEST | Beslut

ECB-rådet beslutar om penningpolitiken i euroområdet. ECB-rådet beslutade idag att sänka de tre styrräntorna med 25 punkter.

EKP:n rahapoliittisia päätöksiä17.4.2025 15:18:52 EEST | Päätös

EKP:n neuvosto päättää euroalueen rahapolitiikasta. EKP:n neuvosto päätti tänään laskea EKP:n kaikkia kolmea ohjauskorkoa 0,25 prosenttiyksikköä.

Kutsu medialle: Eurooppa-päivän konferenssi 9.5.14.4.2025 10:04:10 EEST | Kutsu

Tervetuloa ajatushautomo Bruegelin ja Suomen Pankin yhteiseen Eurooppa-päivän konferenssiin 9. toukokuuta klo 8.30–11.50 Suomen Pankin auditoriossa (Rauhankatu 19, Helsinki).

Räntan på centralbanksinlåningen tyngde Finlands Banks verksamhetsresultat i likhet med året innan28.3.2025 11:00:00 EET | Pressmeddelande

Bankfullmäktige har i dag fastställt Finlands Banks bokslut på framställning av Finlands Banks direktion.

Keskuspankkitalletuksille maksetut korot rasittivat edellisvuoden tapaan Suomen Pankin toiminnallista tulosta28.3.2025 11:00:00 EET | Tiedote

Pankkivaltuusto on tänään vahvistanut Suomen Pankin tilinpäätöksen Suomen Pankin johtokunnan esityksestä.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom