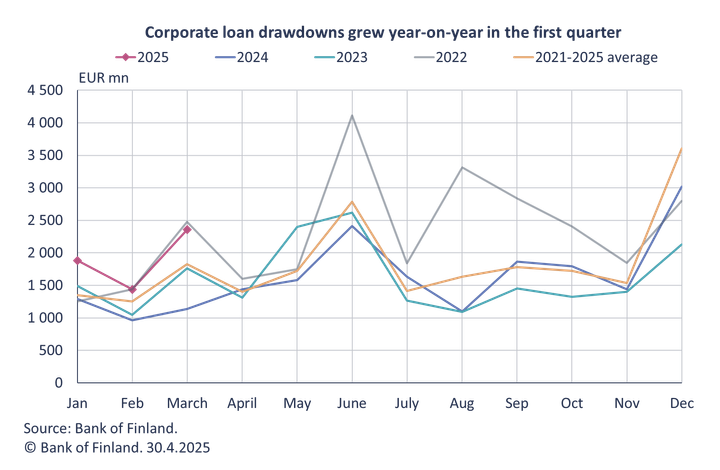

Corporate loan drawdowns picked up from last year

In March 2025, Finnish non-financial corporations (excl. housing corporations) drew over twice as much as in the same period a year earlier. The average interest rate on new corporate-loans fell by from March last year.

In March 2025, Finnish non-financial corporations[1] (excl. housing corporations) drew down a total of EUR 2.4 billion in loans from banks operating in Finland. This was over twice as much as in the same period a year earlier and 36% more than the March average in 2011–2024. In March 2025, the average interest rate on new corporate loans was 4.33%, compared to 5.55% in the same period a year earlier.

The average interest rate on new corporate-loans fell by 1.22 percentage points from March last year. Large new corporate loans experienced a steeper interest rate decline than smaller ones. The average interest rate on small corporate loans of up to EUR 50,000 decreased by 0.4 percentage points from March last year, to 6.85%. Meanwhile, the average interest rate on new corporate loans of over EUR 50,000 and up to 250,000 was 4.88%, having declined by 1.07 percentage points. The average interest rate on the largest loans of over EUR 1 million was 4.13% in March, representing a decline of 1.21 percentage points year-on-year.

In March 2025, the corporate loan stock[2] amounted to EUR 61.6 billion. Despite the higher drawdown volumes in March, the stock of corporate loans contracted by -2.4% year-on-year. Month-on-month, however, the stock expanded by over EUR 300 million in March 2025.

Loans

Drawdowns of new housing loans by Finnish households in March 2025 amounted to EUR 1.2 billion, which was EUR 230 million more than in the same period a year earlier. Buy-to-let housing loans accounted for EUR 130 million of the new housing loan drawdowns. The average interest rate on new housing loans declined from February, to 3.06% in March. At the end of March 2025, the housing loan stock totalled EUR 105.5 billion, and its year-on-year growth was -0.5%. Buy-to-let housing loans accounted for EUR 8.9 billion of the housing loan stock. At the end of March, the household loan stock included EUR 17.6 billion of consumer credit and EUR 17.7 billion of other loans.

In March, Finnish housing corporations drew down EUR 670 million of new loans[3]. The stock of loans granted to housing corporations amounted to EUR 45.4 billion.

Deposits

At the end of March 2025, the stock of Finnish households’ deposits totalled EUR 112.1 billion, and the average interest rate on these deposits was 1.06%. Overnight deposits accounted for EUR 68.4 billion and deposits with an agreed maturity for EUR 14.9 billion of the total deposit stock. In March, new deposit agreements with an agreed maturity made by Finnish households amounted to EUR 1.3 billion. The average interest rate on these new term deposits was 2.45%.

For further information, please contact:

- Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi.

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 2 June 2025.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics.

[1] Excl. overdrafts and credit card credit.

[2] Excl. housing corporations.

[3] Excl. overdrafts and credit card credit.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

BOFIT-prognos: Eskaleringen av handelskriget bromsar upp den ekonomiska tillväxten i Kina och ökar obalanserna i ekonomin28.4.2025 16:00:00 EEST | Pressmeddelande

Finlands Banks forskningsinstitut för tillväxtmarknader (BOFIT) har gett ut sin prognos över den ekonomiska utvecklingen i Kina för 2025–2027.

BOFIT-ennuste: Kauppasodan kärjistyminen hidastaa Kiinan kasvua ja lisää talouden epätasapainoja28.4.2025 16:00:00 EEST | Tiedote

Suomen Pankin nousevien talouksien tutkimuslaitos (BOFIT) julkaisi ennusteensa Kiinan talouden kehityksestä vuosiksi 2025–2027.

BOFIT Forecast: Escalating trade war to slow Chinese growth and aggravate economic imbalances28.4.2025 16:00:00 EEST | Press release

The Bank of Finland’s Institute for Emerging Economies (BOFIT) has released its 2025–2027 forecast for the Chinese economy.

Muistutuskutsu medialle: Eurooppa-päivän konferenssi 9.5.24.4.2025 13:53:27 EEST | Kutsu

Tervetuloa ajatushautomo Bruegelin ja Suomen Pankin yhteiseen Eurooppa-päivän konferenssiin 9. toukokuuta klo 8.30–11.50 Suomen Pankin auditoriossa (Rauhankatu 19, Helsinki).

Finlands Banks chefdirektör deltar i IMF:s vårmöte23.4.2025 12:00:00 EEST | Pressmeddelande

Finlands Banks chefdirektör Olli Rehn deltar i Internationella valutafondens (IMF) vårmöte som hålls i Washington D.C. 24–25 april 2025.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom